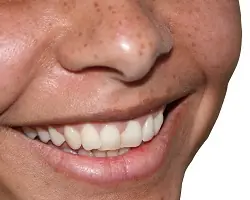

Dental Insurance

Dental Insurance

Compare Dental Insurance policies online, find policies which will cover both check ups and treatment home and abroad.

Dental Insurance makes sense for anyone but those who have trouble free teeth and who can afford a large bill should they have an accident which causes dental damage. Rising dental bills have been an issue for many years and, with the NHS bearing a reducing share of treatment costs, dental insurance is a sensible way of ensuring that dental costs are affordable. It is becoming more and more difficult to even find an NHS dentist that will take on new patients.

There are dental insurance plans available that can help you with the cost of your treatment - although, due to the way they assess your premium, costs can vary considerably. With come insurers you may be rated for cover based on your dental health. The dentist assesses the condition of your teeth and places you in one of number of bands - with rising dental insurance costs involved the more treatment your teeth are likely to need. This means that often it's cheaper for most patients to opt for a 'non assessed' dental insurance policy.

Simplyhealth is an alternative you may wish to consider. With price plans starting from 11 a month, they have 4 different levels of cover each covering the same risks but with differing maximum claim limits. This enables you to be able to buy a policy which will meet your bills whether your dentist is a rural NHS dentist or a city centre private practice. And the good news is, you can choose your own dentist, there is no need to change.

They will cover Check Ups, Routine Examinations and X-Rays as well as Hygienist fees and treatment (or a scale and polish if your dentist does it themselves). Also covered are: Procedural Work such as Fillings, Simple and Surgical Extractions, Crowns Bridges or Dentures, Root Canal work and cover for dental accidents and emergency work up to the maximum claim limits, A one-off payment of up to £5,000 is made if Oral Cancer is diagnosed and this comes as standard.

A major plus point with the Simplyhealth option is that there are no excesses to pay, which is not the case with some all-encompassing medical plans.

If you have existing private medical insurance, companies such as BUPA and AXA-PPP offer private dental treatment insurance as top ups to their private medical insurance policies. They also offer separate Dental Plans if you do not have full private medical insurance.

Boots also offer policies - ranging from around £12 per month (a policy designed to cover the cost of most NHS treatments carried out in England and Wales and contribute towards the cost of NHS treatments in Scotland and Northern Ireland). They have three levels of cover. More expensive plans starting at just around £17 can help with the cost of private treatments as well as providing worldwide accidental cover and offer assistance towards the cost of treating oral cancer.

Simplyhealth

- 4 levels of cover starting from £11.55 per month

- Cover for routine treatment, accidents and emergencies

- Accident and Emergency Treatment covered worldwide

- Quick claims process with no excess