Short Term Car, Motorhome and Van Insurance from Day Insure

Short Term Car, Motorhome and Van Insurance from Day Insure

Short term car insurance | Daily or Weekly Van Insurance | Motorhome Insurance for up to one month

Policy Summary

- Suitable for borrowed or lent vehicles

- Policy can run from 1 hour to 30 days

- Business use included (not hire and reward)

- Any No Claims Discount is unaffected by this cover

- UK licence holders

Policy Criteria

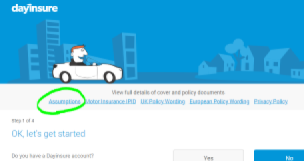

Please read the assumptions on the Day Insure website to ensure you, and the vehicle you are looking to insure meet their criteria.

How does Short Term Motor insurance work?

Firstly get a quote through our Dayinsure short term insurance quotation service. You can select the type of vehicle and length of cover from one hour's insurance to 30 days cover. Be aware that it is cheaper to buy 14 day car insurance or 28 day motor insurance than a number of individual weekly car insurance policies. Once your details have been input you will receive a quotation from DayInsure for their Aviva underwritten insurance policy.

If you are happy with the quote you will be asked for a little further information and you will need to agree to the company's acceptance criteria which ensures you are eligible for cover. You will be able to check the details you have entered and then proceed to payment. Completing the purchase of the cover takes only a few minutes.

What vehicles can be covered by Short Term Insurance?

Dayinsure policies can insure the widest range of vehicles available on the market. This includes cars and vans up to a value of £60,000 (fully comprehensive cover to this value is available), motorhomes up to 3.5t (Dayinsure is the only UK short term insurer offering cover on these vehicles) and some classic/cherished vehicles.

Some very high performance cars and exotic vehicles are excluded. The Day Insure policies offer a wide range of insurance products to suit your needs and are underwritten by Aviva, one of the UK's largest insurers.

Who can buy Short Term Insurance?

Most drivers are able to buy short term insurance, although cover cannot be provided for under 18 year olds (under 25 for motorhomes), those who live in some higher risk postcodes, customers who have held their driving licence less than 6 months (3 months if over 25) or who do not have a full UK licence.

Drivers who have had too many claims or have too many points on their licence are also excluded. See the appropriate eligibility criteria for more information. It's under the Assumptions link on the Dayinsure site.

Please note we are not recommending this policy as suitable for you as we are unable to assess your personal suitability or eligibility for the policy. Please therefore read the terms and conditions carefully if considering it further.

Alternative short term insurance policies are available in the market including those on our Short Term Car insurance and Short Term Van insurance pages.

Day Insure

- Policies from one hour to 30 days

- Covers drivers from 18 to 75

- Covers Cars, Vans and Motorhomes

- Optional Breakdown and European Cover